Enter a Payment

There are 6 steps to enter a payment.

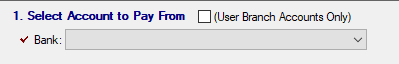

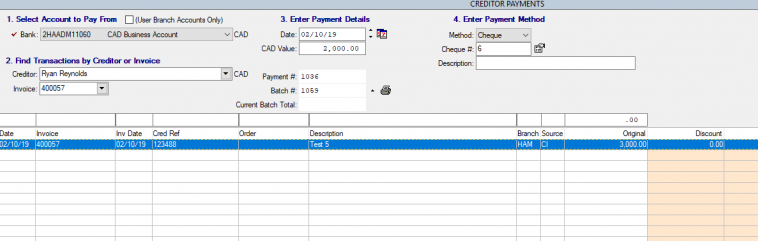

Step 1 – Select Account to Pay From:

Select the account that the payment is being made from. The drop-down menu will show accounts setup as Bank Accounts, or Electronic Clearing in the General Ledger Setup. Bank Accounts will create a journal entry going directly to the selected bank account, while the Electronic Clearing account will instead send the receipt to the Electronic Clearing account which will require another step (Banking > Electronic Clearing) to take it to the bank account (Usually for creating uploads to the bank to create the payment).

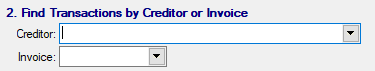

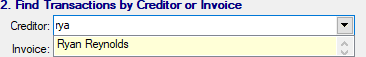

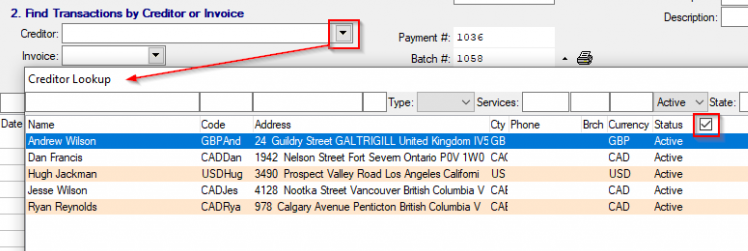

Step 2 – Find Transactions by Creditor or Invoice

There are 2 ways to locate the purchase invoice to pay. The Vendor/Supplier can be selected by either typing in the name in the field, where Moveware will provide suggestions to select:

Or, by using the drop-down menu to bring up a supplier look up where by default it will only show suppliers with balances, which can be toggled off if necessary (Toggle on Balance column):

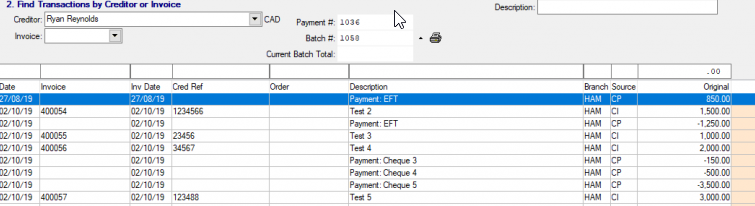

Selecting of a Supplier will list the currently outstanding transactions of that supplier in the body of the payment menu:

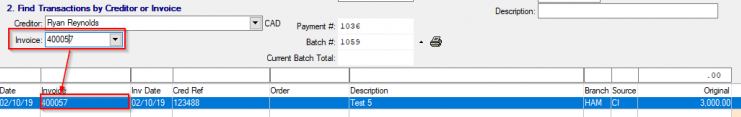

Alternatively, search can be done by Invoice Number as well, but searching by Invoice Number will only allow payment against the searched invoice (Search can be done by either supplier invoice number, or Purchase Number):

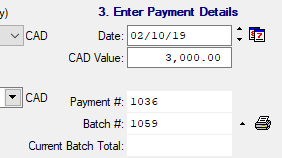

Step 3 – Enter Payment Details

Depending on the bank account currency and invoice currency, there may be a foreign exchange rate to this step. This process is outlined in Enter a Foreign Currency Payment. This payment field will auto calculate by double clicking on a line, adding the invoice total to the payment total.

Date: Date of the Payment, can alter the date by either selecting the calendar button ![]() , or using the arrows next to the date field. Keyboard shortcuts F9 = Current Date, F10 = 1 Day Up, F11 = 1 Day Down.

, or using the arrows next to the date field. Keyboard shortcuts F9 = Current Date, F10 = 1 Day Up, F11 = 1 Day Down.

Currency Value: Amount that will be leaving the bank, which may differ in the amount being paid to the supplier in situations where there are discounts, or bank fees which will be recorded in step 5.

Payment #: This is the number assigned to the payment. This is an internal number that will continually increase with each subsequent payment.

Batch #: An internal number utilized for searching or for creating a payment file. The batch number will increase if the payment screen is exited, or if manually progressed. The Batch will be a group of payments. ![]()

Print Current Batch of Payments: Prints a report giving a summary of all the payments in the batch . ![]()

Current Batch Total: Displays the total amount of the payments in the current batch.

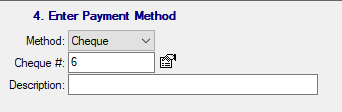

Step 4 – Enter Payment Method

Method: Depending on the method selected, other fields will become available (Cheque #, etc.). Used for filtering information later when creating a bank export document, or reports. Payment Method: Cheque for example will allow for printing physical cheques.

Description: Description appears on the journal entry and in reports.

Step 5 – Apply Payment

Applying the total balance to invoices to pay. This step includes Finance Charges, Card Surcharges, and Discounts. This stage will also include foreign exchange gain/loss on a foreign currency transaction (Refer to Enter a Foreign Currency Payment).

Value: Amount of the payment leaving the bank (Stage 3)

Applied: Total amount Applied to the invoices. All applied balances will appear in the Applied Column, which can be manually entered, or adding full/remaining amount of the payment by double clicking on the invoice (outside the green columns).

Finance: This is the bank charges and should be entered as a positive balance usually (950.00 purchase invoice, 50.00 bank fee to process payment, 1,000.00 leaves the bank (950.00 invoice + 50.00 bank fee)). By default, this charge will go to the Finance Charge linked account, but the account can be overwritten by using the Modify G/L button to bring up a GL lookup pop-up menu. ![]()

Tax Code: Affects the Surcharge and Discount fields to determine what tax rate should be used on the balances.

Surcharge: Similar to Finance, a surcharge is often added when paying by credit card, and this surcharge is often passed onto the payer. The invoice won’t include this fee, so it will be added on this screen as an additional cost. Should be recorded as a positive amount

Discount: Totals the amounts entered in the Discount Column. Discount balances will go to the Discounts Received linked account but can be overwritten using the Modify G/L button to bring up a GL lookup pop-up menu.

Unapplied: Any balance not applied to an invoice will be recorded as an unapplied payment on the supplier’s file. A warning will be provided if there is an unapplied balance ensuring the balance should be left unapplied and given further details if desired. These balances can be applied to invoices using the Apply tab (Refer to Supplier Management – Apply).

Step 6 – Post Payment

Posting the payment will create a payment journal (CP) in the General Ledger. By default, the journal will be created as an Updated Journal (Status U), but the ability to post as an unposted journal (Status N) is available.