Stripe FAQ

General

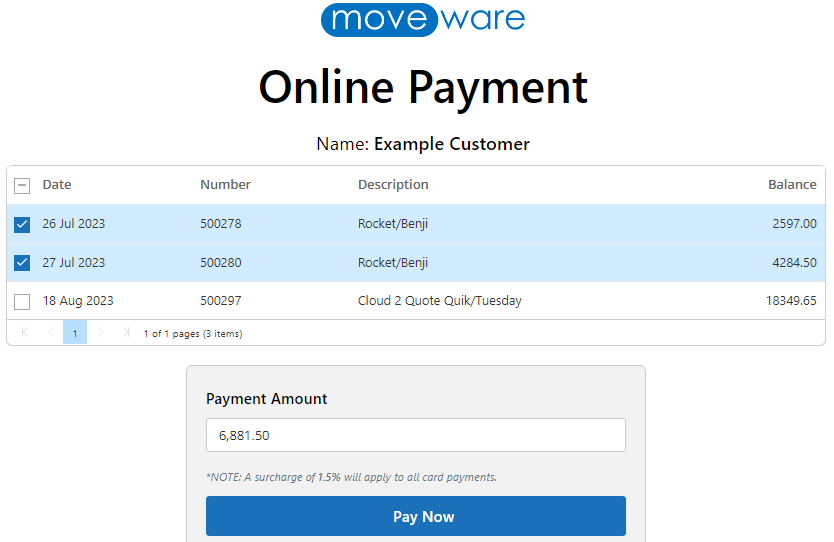

Is there a customer portal where clients can view and pay their invoices online?

Yes, Moveware is pleased to announce the ability for clients to review, select and pay all their outstanding invoices online has been added in the January 2024 release. This feature will be added to your system during the Stripe implementation.

How often will Stripe payout settled payments?

Payouts from stripe can be scheduled daily, weekly or monthly or manually on demand. Depending on your country, it can take 2-7 business day for a processed payment to settle in Stripe before they are eligible for payout.

For more information on Stripe payouts, please refer to the documentation here.

How do I refund a payment?

Payments can only be refunded through the Stripe portal.

Once the refund has been issued through the Stripe portal, users will need to manually record a negative receipt in Moveware to account for the refund.

The ability to refund a customer from Moveware and record the transaction automatically is planned for a future release. We will announce these changes as they are released.

Can I charge in different currencies?

A payment can be processed in any currency, based on the currency set against the customer in Moveware. Foreign currencies are converted to your Stripe account currency and a receipt is created in Moveware for the corresponding foreign and local amounts.

Please note that Moveware will only create receipts where your Stripe account currency matches your Moveware base currency. For example, if your base currency is set to GBP, your Stripe account currency must also be GBP for receipts to appear in Moveware.

Is Stripe 3D Secure 2 (3DS2) compatible?

Stripe is 3DS2 compatible and it will automatically use 3DS2 when supported by the cardholder’s bank.

Can we take phone payments through Moveware?

A payment can be taken over the phone by clicking on the pay online button on the job or the invoice. This will take the Moveware user to a payment page where they can enter card details and process a payment. The receipt will be automatically created in Moveware. The user will likely need to complete 3DS Two Factor Authentication, so they will need to work with the customer to get the code.

If you are processing payments on behalf of a customer over the phone, please ensure you have adequate processes in place for protecting your customers card information in accordance with PCI compliance.

An alternative to this is to your client a direct debit email link, where they can go and save their card details for later use. The customer will complete 3DS Two Factor Authentication themselves and once completed, the Moveware user will be able to process the payment using the saved card information.

Direct Debits

Can I take a payment for direct debit via a bank account?

Direct Debits via bank account are available in Australia, United Kingdom, United States, Canada and most of Europe. If you would like to use this facility, please contact Moveware so we can guide you through the process to enable it on your Stripe account.

My direct debit has returned a ‘Requires Action’ failed payment message? How do we handle this?

This is caused by 3DS requirements from the card issuer. When a client signs up for direct debit, they will enter their card details and the bank will likely prompt them to complete 3DS Two Factor Authentication. Once completed, the details will be returned to Moveware.

When the Moveware user tries to take a direct debit payment using the saved details, the card issuer may require 3DS to be completed again. As this is being performed by the Moveware User, it’s impossible for them to complete without getting in touch with the card holder. Stripe will send Moveware a URL for the cardholder to complete 3DS, which we store in the event log against the invoice. The URL needs to be sent to the card holder to complete, and once that’s been done, the payment will finish processing.

Fees and Surcharges

Can I add a surcharge to our customer invoices?

Moveware is able to add a fixed percentage surcharge to all card payments through our gateway. Please contact Moveware if you would like to add a surcharge or change an existing one.

How do we account for tax on Stripe charges?

If your Stripe fees are subject to tax, this will automatically be recorded in Moveware in the receipt.

How do we account for credit card surcharges?

If you are charging your customers a credit card surcharge through Stripe, we will automatically populate this data in the Stripe receipt that is returned to Moveware. Tax is calculated in the following method:

If a payment is directly linked to an invoice, Moveware use the overall tax rate from the invoice to determine the tax to be applied to the surcharge. If the payment is not linked to an invoice, i.e. for a job deposit, Moveware will use the tax code that’s assigned to your card surcharge account defined in General Ledger ->Setup.

Credit card surcharges are applied to both customer initiated payments and card direct debits. If you would like these surcharges to differ, please contact Moveware.