- Featured Product: Online Payments (Stripe)

- Meet Moveware

- Getting Started

- Jobs

- The Job Life Cycle and Statuses

- Jobs – Search

- Jobs – Details

- Jobs – DSP

- Jobs – Diary

- Jobs – Contact

- Jobs – Costing

- Jobs – Costing Interface

- The Costing Life Cycle

- Add a Cost Option

- Add Estimated Costs and Suppliers in Costing

- Add a Sell Price in Costing

- Add a Cost Line to a Cost Option

- Print a Quote for a Cost Option

- The Status Q Cost Option

- Modify the Cost Option Details

- The Option Total Line

- Add Actual Costs and Post a Purchase

- Accruals in Job Costing

- Multiple Currencies in Jobs Costing

- Enter Foreign Currency Costs and Sell Prices

- Add an Additional Cost Option

- Combine Cost Options

- Misc Job Types Costing

- Cancel a Cost Option

- Change a Cost Option Customer (Debtor)

- Change a Supplier (Creditor) of a Costing Line

- Set a Costing Line as No Charge

- Set a Cost Option as No Charge

- Create a Costing Credit Note

- Internal Resource Costs

- Jobs – Costing Fields

- Jobs – Invoicing

- Jobs – Invoicing Interface

- Create an Invoice in Jobs

- Modify Invoice Header Information

- Modify Invoice Charge Lines

- Invoice One Total Line

- Post an Invoice in Jobs

- Print an Invoice in Jobs

- Unlink an Invoice from a Cost Option

- Add a Credit Note

- Add an Additional Invoice

- Partial Invoicing

- Jobs – Invoicing Fields

- Jobs – Inventory

- Jobs – Resources

- Jobs – Import / Export

- Jobs – Waybill

- Jobs – Storage

- Jobs – Review

- Jobs – Claims

- Job Folder

- Baggage

- Fine Art

- Corporate (CRM)

- Sales

- Daily Diary (Operations Diary)

- Operations Diary Icons and Filters

- Operations Diary Notes

- Allocate Resources in the Operations Diary

- Close a Day from the Operations Diary

- Confirm Start Times

- Diary Actions in the Operations Diary

- Print the Operations Diary

- SMS Messages in the Operations Diary

- Enter Actual Times in the Operations Diary

- Operations Diary – Planner Tab

- Organizer

- Waybills

- Operations

- Full Screen Dispatch

- Container Movements

- Crates

- Destination Summary

- Fleet

- Inventory Management

- Labels

- Asset Management

- Object Management

- Resource Usage

- Start Times

- Timesheets

- Workload

- Diary Messages

- International

- Quality

- Storage

- Storage Management

- Storage Invoicing

- Storage Rate Revision

- Storage Locations

- Warehouse Management

- Customers

- Customer Management

- Customer Ageing

- Combined Invoicing

- Customer Approval Setup

- Invoicing

- Invoice Update

- Receipting

- Receipt Listing

- Receipts Import

- Van Line Clearing

- Suppliers

- Supplier Management

- Purchases

- Create a Manual Purchase Invoice

- Apply a Purchase Invoice to a Job

- Apply a Purchase Invoice to a Waybill

- Apply a Purchase Invoice to an Inventory

- Assign a Purchase Invoice for Approval

- Cancel a Purchase Invoice

- Email a Purchase Invoice

- Purchase Invoicing in Foreign Currency

- Modify a Purchase Invoice

- Place a Purchase Invoice on Hold

- Print a Purchase Invoice

- Reverse a Posted Purchase Invoice

- Search for a Purchase Invoice

- Purchase Event Log

- Purchase Approval

- Purchase Update

- Purchase Import / Export

- Accruals Management

- Payments

- Payment Batch

- Payment Listing

- Purchase Orders

- Contra Accounts

- Subcontractor Payments

- General Ledger

- Chart of Accounts

- General Ledger Setup

- General Ledger Inquiry

- General Ledger Journals

- General Ledger Accounting Close Date

- Budgets

- Sales Budgets

- Tax Return Module

- Banking

- Employees

- Employee Management

- Employee Payroll

- Employee Payroll Update

- Employee Payroll Admin

- Single Touch Payroll

- STP Phase 2 – Quick Start Guide

- STP Phase 2 – FAQ

- Moveware STP Configuration

- STP Workflow

- STP Reporting

- STP Corrections

- STP Data Export Fields and Requirements

- Administration

- Moveware Setup

- Bank Accounts

- Branch Management

- Calendar Management

- Codes Management

- Company Management

- Cost Centres

- Destinations

- Diary Actions

- Diary Messages

- Internal Phone Book

- Inventory Management

- Inventory Management – Containers

- Inventory Management – Crates

- Inventory Management – Furniture

- Inventory Management – Labour

- Inventory Management – Office Equipment

- Inventory Management – Other

- Inventory Management – Packing Materials

- Inventory Management – Storage

- Inventory Management – Vehicles

- Inventory Management – Vessels

- Job Products

- Job Types Management

- Locations

- News and Information

- Paragraph Management

- Ports Management

- Postcodes

- Rates Management

- Review Setup

- Sales Representatives

- Supplier Products

- Tax Codes

- Waybill Payment Messages

- Web Setup

- System Setup

- Codes

- Error Log

- Event Log

- Groups

- Menu Management

- MoveConnect

- MoveConnect Log Viewer

- Remote Printers

- Report Configuration

- Security Management

- System Settings

- System Start Numbers

- System Parameters

- User Management

- Mobi Setup

- Keeping Mobi Updated

- Set Up Employees to Use Mobi

- Configure Mobi Settings

- All Mobi Settings

- Language Setup

- Configure Pre-Set Paragraphs

- How to Customize Menus, Reports, and Reviews in Mobi

- Editing Inventory Item Button Ribbon

- Customize Mobi Inventory Buttons

- Defaulting Methods in Mobi

- Mobi Barcoding

- Configuring Mobi Costing Menu

- Send E-mails from Mobi

- How to Activate Mobi Automatic E-mail/SMS

- Set up a Feedback Form

- Exporting Data Out of Mobi

- Utilities

- Reports

- Generate Reports

- Set a Custom Report

- Print Reports

- Schedule Reports

- Configure Reports

- Reports – Favourites

- Reports – Sales

- Reports – Export

- Reports – Import

- Reports – Operations

- Reports – Storage

- Reports – CRM (Corporate)

- Reports – Customers

- Reports – Suppliers

- Reports – General Ledger

- Reports – Employees

- Reports – Analysis

- Reports – Other

- Reports – Schedule

- Moveware Applications

- MobiCrew

- Download and Log Into Mobi (MobiCrew)

- Sync Information in Mobi

- Mobi Interface and Menus

- Mobi Jobs

- Search Screen

- Summary Screen

- Notes Screen

- Addresses Screen

- Diary Screen

- Messages Screen

- Status Screen

- Inventory Screen

- Mobi Vehicle Receipting and Condition Reporting

- Materials Screen

- Manage Materials

- Costing Screen

- Client Signoff

- Reviews Screen

- Print Screen

- Check Off Screen

- Timesheet

- Download Screen

- Vehicle Documents

- Mobi Warehouse

- Mobi Fine Art

- Mobi Submit Feedback Menu

- MobiSurvey

- Online Payments

- MoveSurvey

- MoveSurvey Setup

- Install MoveSurvey

- MoveSurvey Wizard

- MoveSurvey – Import Onto Another Device

- Moveware Codes for MoveSurvey

- Set up MoveSurvey Users

- Set up Job Products for MoveSurvey

- Set up Inventory for MoveSurvey

- Moveware reports in MoveSurvey

- Run MoveSurvey

- Enabling the Camera Permissions in MoveSurvey

- Uninstall MoveSurvey

- Using MoveSurvey

- MoveSurvey Main Menu

- Synchronise Data in MoveSurvey

- MoveSurvey – Search

- MoveSurvey – Details

- MoveSurvey – Notes

- MoveSurvey – Diary

- MoveSurvey – Inventory

- MoveSurvey – Review

- MoveSurvey – Resources

- MoveSurvey – Account

- MoveSurvey – Client Summary

- MoveSurvey – Reports

- MoveSurvey – Tools

- MoveSurvey Photos & Attachments

- MoveCrew

- MoveCrew Setup

- Using MoveCrew

- MoveSMS

- MoveTransfer

- Portal

- Web Portal – Moveware Admin Guide

- Web Portal – Move Manager Guide

- Web Portal – Client Guide

- Web Portal – Online Quote

- Web Portal – Partner Guide

- Third Party Interfaces

- 1-Stop

- A3

- ABF

- Adobe Sign

- ADP Payroll

- Allied Van Lines Canada

- Altair

- ANZ

- Ariba

- Australian ABA File

- Bambora

- Bank of NZ

- Bekins Van Lines

- Canadian Banking Files

- Cargowise

- Compare Quotes

- Credit Cards

- CustomsController

- Daycos

- Dimensions (Access)

- Dynamics Business Central

- Dynamics Navision

- EasyDPS

- eMyLeads

- Enterprise

- Exactus

- Exact

- Ezidebit

- FMS

- Fuel Card Interfaces

- Great Plains

- Happy to Serve

- Harmony

- Hockingstuart

- IBS

- ISF Integration

- LogiX

- Make Tax Digital

- Manpack3

- Maximizer

- Moving24

- MSP

- MVF / MoveHub

- MyDHL+

- NAB Transact

- NEDVAN

- NES (National Export System)

- New Zealand Banking File

- New Zealand Defence Force

- New Zealand Ministry of Education

- New Zealand Police

- OFAC

- Orphee (Groupage)

- Parsifal PRISM

- Pasha

- Podium

- Quickbooks

- RHA

- Royal Mail PAF

- Royal Wolf

- Sage

- SAP

- SAP Ariba

- SCF

- SEPA File

- South African Banking Files

- SuperStream

- Techmate

- Trackfreight

- TriGlobal

- Twilio

- UK BACS File

- U.S. Bank – Multi Payment Export

- U.S. NACHA File

- Visma Global

- Weichert

- Westpac NZ

- Westpac (PayWay)

- Worldpay

- World Office

- Wheatons Van Lines

- Xero

- Moveware Hosting Platform

- Infrastructure Setup

- Moveware Infrastructure Setup

- Product Requirements

- Recommended Settings for Windows Desktop Resolution

- General Settings

- Install Moveware Client on Terminal Server or Workstation

- Install Crystal Reports Runtime Files (Manually)

- Install Moveware PDF (Manually)

- Moveware Database Setup

- Database Client Tools

- Disaster Recovery

- Moveware System Security

- Moveware System Backup

- Moveware System Restore

- Ransomware

- Set up a Microsoft Scheduled Task

- Set up a Moveware Database and Backup Procedure on a Client’s Server

- Windows Update Settings

- Windows Virus & Ransomware Protection

- Glossary

- Help and Support

Purchase Invoices can be created on a Job or on a Waybill.

Manual Purchase Invoices can also be created at any time from the Purchases module, and can then be linked to a Job or linked to a Waybill.

Manual Purchase Invoices can also be created to reflect administrative costs, which would not relate to any specific job.

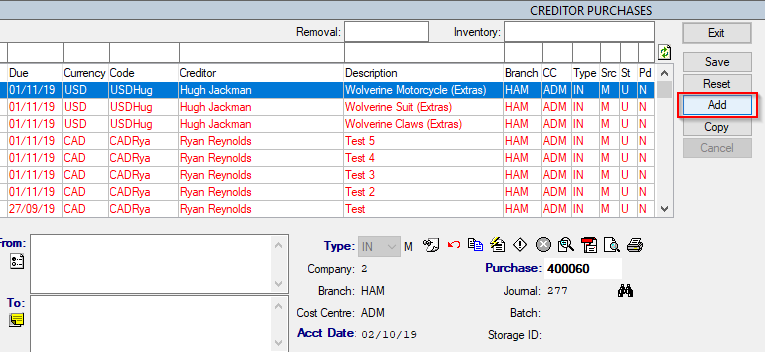

How to Create a Manual Purchase Invoice

- Click on the Add button to create a new Purchase Invoice.

A Supplier Lookup window is opened from which an existing Supplier can be selected. Double click the Customer or select it and click OK. Supplier information will then be automatically populated into the Purchase Invoice header including the Payment Terms. To create a new Supplier, refer to Adding New Suppliers.

Note: The Type has defaulted to Invoice (IN), the Company, Branch, and Cost Centre are defaulted as per the Users default settings.

- If the Invoice relates to a specific storage account, double click on the Storage ID field and select an account.

- Enter the Account Date (financial date of the transaction), Invoice Date (Supplier Invoice date) and the Supplier’s Invoice Number.

- Enter as many Purchase Invoice details as possible.

- Click Save. Mandatory fields will appear red if incomplete. The invoice can only be saved once these fields are completed.

The Supplier Purchases window will show the newly created Credit Note or Adjustment. It may now be put on hold, cancelled, or posted.

Note: The Type is defaulted to Invoice (IN), the Company, Branch and Cost Centre are defaulted as per the user’s default settings. The type may also be set to Credit Note (CR) or Adjustment (ADJ).

Once the header information is saved, Purchase Charges will be added and displayed at the bottom of the Suppliers Purchase module. They may be a chargeable item or a comment. The charge line contains the value, tax amount, and the detail of the Branch, Cost Centre and General Ledger Subcode (usually linked to a cost of sales/expense account but may be linked to other accounts if necessary) of the charge which is used to determine the General Ledger Account when posting the purchase invoice. The list of available charging options is contained in Supplier Products.

Moveware allows job costs that are entered in Supplier Purchases to be written back as actuals into the Costing tab of the job. This can be done on an individual job basis or alternatively to all jobs as required that are on a Waybill. Waybill costs can be applied on a pro rata meterage basis or applied individually to each job.

How to Add Details to the Purchase Invoice

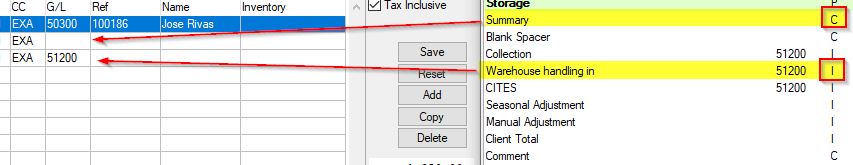

- Click the Add button adjacent to the charge line table to bring up a list of relevant charges (also known as Supplier Products).

- From the resulting list of Supplier Products select the required charges. A Comment charge may be added. These are labelled as Type C (Comment) rather than type I (Invoice).

Note: By default, the charge Description, Tax Code, Branch, CC and Revenue Code are set from the System Defaults. These can then be edited as required. - Only enter a Quantity and Rate details if you require a calculation (i.e. Packing), otherwise you can simply enter a line total directly into the Value column. Values can be entered exclusive or inclusive of tax by checking or un-checking the Tax Inclusive field. Rates can be setup for Supplier Products, and amounts will populate by default if rates are setup. (Supplier Products in Administration menu).

Note: For a Credit Note the Rate and/or Value must be entered as a negative (-) value i.e. -100.00. - Charges can be added and applied to a Job or Waybill. See Applying a Purchase Invoices to a Job or Waybill.

- Click Save at the bottom of the module when completed.